WASHINGTON — The U.S. Navy has asked for a budget that would boost near-term readiness by investing in ship and aircraft maintenance but shrinks procurement and force structure, again pausing plans to grow the fleet.

The Navy’s fiscal 2022 budget request, released May 28, addresses future requirements through a beefed-up research and development account, and the Marine Corps is moving on some acquisition efforts that support its Force Design 2030 effort. But the actual size of the Navy fleet was a lower priority given the top-line spending levels in FY22, the deputy assistant secretary of the Navy for budget told reporters in a May 28 press briefing.

“The goal of the department was to balance the first priority, which is investment in Columbia[-class submarine] recapitalization; the second priority, which is to prioritize readiness to deliver a combat-credible force for today; invest in lethality and modernization; and then grow the war-fighting capacity at a rate supported by our budget controls,” Rear Adm. John Gumbleton said.

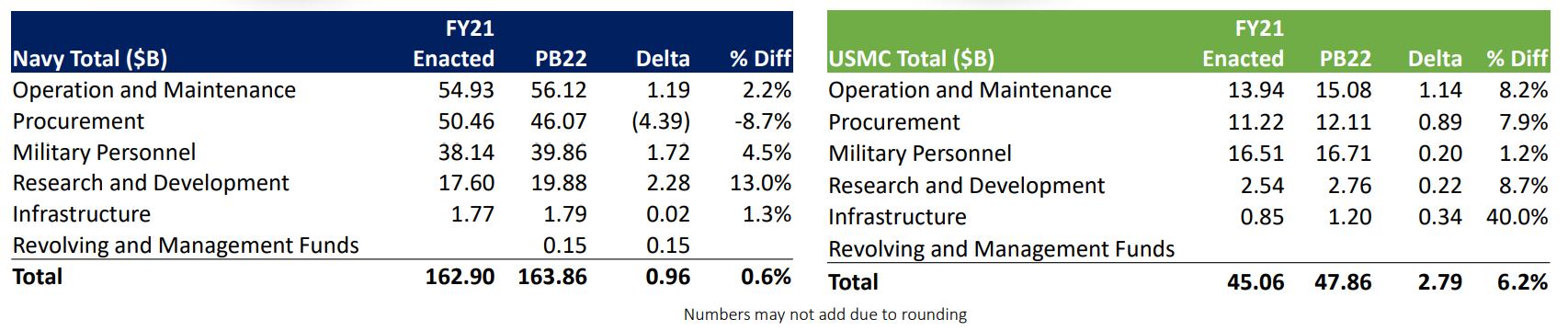

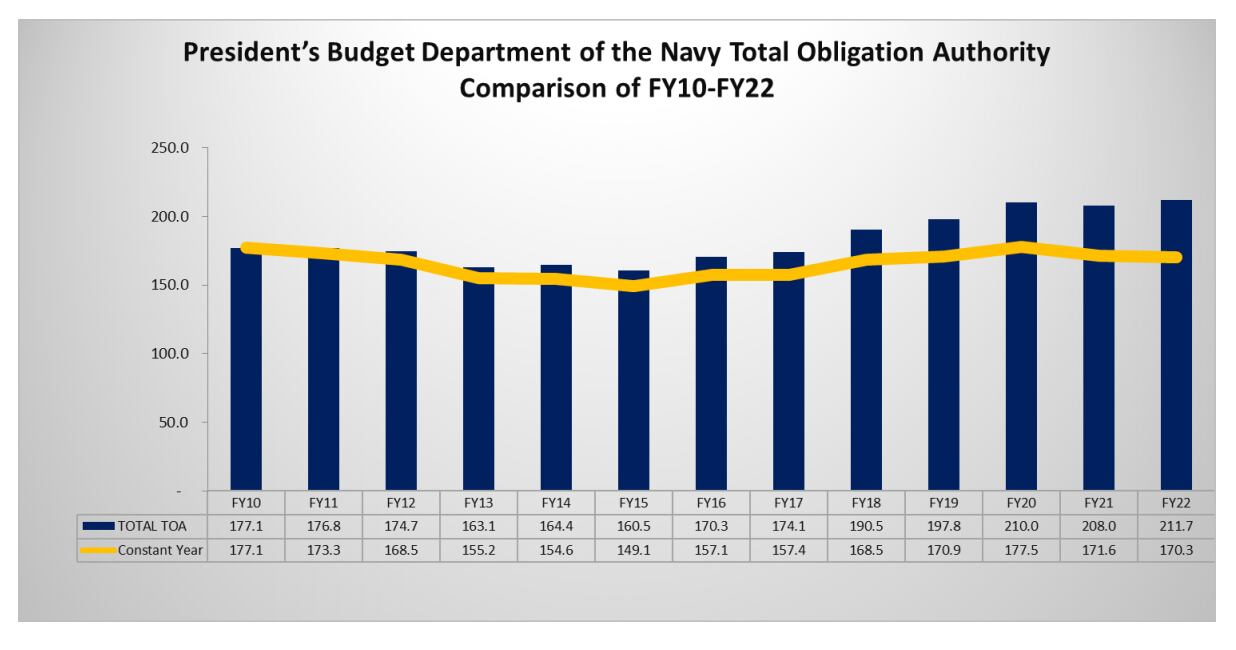

The Department of the Navy overall requested $211.7 billion in spending, which is a 1.8-percent increase in top line compared to the FY21 request. The Navy’s portion of that, though is $163.9 billion, or just 0.6 percent more than FY21. The Marine Corps requested $47.9 billion, a 6.2 percent increase as it overhauls the force on a short timeline to become more agile and ready for littoral operations.

The Navy requested eight ships this year — four warships and four support ships — for a total of $22.6 billion, or a 3 percent reduction compared to FY21. The sea service also asked for $16.5 billion to buy 107 aircraft, which is down 15.6 percent in funding and 37 aircraft compared to FY21.

Overall, the Navy wrote in a budget document, “our procurement accounts decrease by 5.7 percent to fund the increases in operation and maintenance (up 3.4 percent), military personnel (up 3.5 percent), research and development (up 12.4 percent), and infrastructure accounts (up 13.9 percent) as we seek to innovate and modernize the force while maintaining and enhancing readiness and people-focused programs.”

The service noted that the decreased shipbuilding account was carefully crafted to balance requirements, resources and industrial base needs, “weighing the effects of our program decisions on the industrial base to ensure our nation maintains the skills, capabilities, and capacities critical to our national defense.”

Gumbleton, in his briefing, acknowledged that eight ships will not put the Navy on a path to grow to 355 ships, which was identified in 2016 as a target size for the fleet. More recent fleet studies suggest the Navy should aim even higher through a mix of manned and unmanned ships.

“Eight ships a year is not going to get to 355. All things being equal, if you have a 300-ship Navy and a 30-year [service life for the average ship], you have to recapitalize at 10 per year, so eight is not going to do it. That said, we’re consistent with last year’s request of eight ships; we’re requesting eight this year again, and we have to manage,” he said.

“Again, it’s all about not having a hollow force: making sure we’re ready today, modernizing for tomorrow and then the investment for the future. And with this top line allocated, this is the right blend to do that,” he added.

In FY21, the Navy asked for eight ships, two of which were tugboats to support the fleet. The request was immediately rejected by lawmakers who focus on the Navy portfolio. They said the request was not in line with Navy future force studies that called for a trajectory to 355 or even 400-plus battle force ships required to deter or defeat high-end threats like China or Russia.

The most recent budget request is likely to draw greater criticism. Of the eight ships, only four are warships: two Virginia-class attack submarines, one Arleigh Burke-class destroyer and one Constellation-class frigate. The other four are support ships: one John Lewis-class fleet oiler; two towing, salvage and rescue ships; and one ocean surveillance ship.

Budget documents make clear that funding current Navy operations — which have strained the fleet, especially aircraft carriers, in recent years — and maintenance is a top priority, more so than expanding the fleet. Leaders, including Chief of Naval Operations Adm. Mike Gilday, have long said they wanted a balanced fleet more than a larger fleet, which is what this budget request aims to do.

“Navy and Marine Corps forces remain deeply engaged, at a high operational tempo providing National Command Authority immediate options, assuring allies and deterring our adversaries. The FY 2022 budget builds on the effort from the FY 2021 budget and incorporates new administration priorities, focused on improving readiness in Navy major readiness and enabling accounts that support training and deploying our forces,” the budget document read.

This readiness-focused budget comes as the Navy and Marine Corps showed through extensive war gaming and analysis — which was further supported by a second Office of the Secretary of Defense-led analytic effort — that the fleet needs to grow, become more agile and distributed, and rely more on unmanned platforms and small ships if it’s going to compete with China.

In 2019 and 2020, the Navy and Marine Corps conducted a major future fleet architecture study to outline what they need to look like around 2030 to deter China but also win in a conflict against the Asian power if one arose.

Rather than release the results of the study and the long-range shipbuilding plan that reflected the study’s conclusions, then-Defense Secretary Mark Esper in February 2020 declined to release them publicly or to Congress, instead launching his own Future Naval Fleet Study to look at a longer time frame, out to 2045. His study, which wrapped up in the fall, came to largely the same conclusions but called for an even bigger fleet with even more unmanned systems to account for an even larger Chinese threat at the longer time frame.

As a result, the FY21 budget request released last year did not reflect the new direction the Navy and Marine Corps are trying to go. The services and Esper’s office had finally come to an agreement on that direction, raising hopes that the Navy might be able to start moving in that direction come FY22. However, the FY22 budget request from the office of Defense Secretary Lloyd Austin again does not support moving in that direction.

Acquisition

The FY22 plan buys two Virginia-class attack submarines, in line with the multiyear procurement contract with prime contractor General Dynamics Electric Boat. It also buys one Arleigh Burke destroyer, though a multiyear contract with the yards of General Dynamics’ Bath Iron Works and Huntington Ingalls Industries’ Ingalls Shipbuilding promised one ship a year to each builder in FY22.

The budget request also includes one Constellation-class frigate, the third in the new class that is built by Fincantieri at its Marinette Marine yard.

The two-submarine buy is consistent with the future operating concept that will call for a larger sub fleet. The Navy will need to increase production in the future beyond two a year to reach its goal of 70 to 80 subs, as outlined in Esper’s Future Naval Force Study, but the service recently acknowledged that the industrial base cannot handle that capacity right now.

Esper said when rolling out his study results that the Navy would need to increase to three subs a year to meet the threat. Today, the Navy has 50 submarines.

The one-destroyer buy is also consistent with future operating concepts, though it’s unclear what it means for the existing multiyear contract. The Navy will begin operating more small and unmanned ships and fewer large ships, both to spread out lethality across a vast area — chiefly, in the Pacific — and to challenge an adversary’s targeting abilities by taking away bigger and easier targets.

The Navy will need to continue buying Flight III Arleigh Burkes, in part to replace the aging cruiser fleet, but it doesn’t need to accelerate its production rate to reach a large combatant force — both cruisers and destroyers — that will rise to 100 in the near term but then fall to 74, in line with the Navy’s plans to de-emphasize large combatants’ role in distributed operations.

Though in line with operating concepts, the move has implications for industry. Gumbleton said during the press briefing that the Navy would pay a $33-million penalty for breaking the terms of its multiyear procurement contract with either Bath Iron Works or Ingalls Shipbuilding, but he added that “this was clearly a hard choice with respect to what we could afford” and that the Navy needed to spend the money instead on readiness, modernization and investments in future technologies.

The Navy is expected to speed up the frigate production line in 2023 and will need to expand to a second yard to build as many as four ships a year to reach Esper’s planned 60-70 small combatants. The request keeps to just one frigate for FY22 until next year’s expected increase — likely two at Fincantieri and one at a new yard yet to be announced.

Though not contributing to the ship acquisition count, the Navy is also spending $4.6 billion on a second increment of multiyear funding for the first Columbia-class ballistic missile submarine, which was an FY21 buy. The budget also includes $2.4 billion in incremental funding for two aircraft carriers bought in a previous two-ship contract. And five used sealift ships will be purchased to supplement the fleet in what Gumbleton called the most affordable procurement model.

On the aircraft side, the Navy continues with its plans to let the F/A-18E/F Super Hornet production line end. It would buy 20 F-35C Joint Strike Fighter carrier variants and 17 F-35B vertical landing variants in FY22, as well as five E-2D Advanced Hawkeyes for the carrier air wing and six KC-130J tanker and transport planes for the Marine Corps.

The budget request also includes nine CH-53K King Stallion heavy-lift helicopters for the Marines, eight CMV-22B Ospreys for the Navy — which will replace the C-2A as the carrier onboard delivery platform to support deployed aircraft carriers — and 36 TH-73A advanced helicopter trainers.

For the first time, the Marines will buy six medium-altitude, long-endurance unmanned aircraft that will be land-based and support new Marine littoral regiments.

The Marine Corps, which is moving quickly to buy new kit for its future operations, plans to spend $47.9 million to start buying Naval Strike Missiles that will be fired from unmanned ground vehicles. The service will also buy 92 Amphibious Combat Vehicles as the program accelerates under the second full-rate production lot contract with BAE Systems.

To support future operating concepts, the Navy is investing heavily in networks, sensors and other supporting elements of a Naval Operational Architecture that will allow a dispersed fleet of ships and aircraft, both manned and unmanned, to share data and allow the best-positioned platform to engage with a target using all the information at the whole fleet’s disposal.

Gumbleton would not discuss a dollar amount for the Navy’s main contribution to this effort, Project Overmatch. He said there are three budget lines in the research and development portfolio that support Overmatch, but they are classified.

“Project Overmatch is the priority right behind Columbia [submarines], and so it competes quite well for funds. I wouldn’t say it’s resource-limited at all,” he said during the briefing.

Decommissioning and divesting

The Navy plans to retire 15 ships in FY22, some of which were already planned and some of which are meant to support a “divest to invest” strategy to free up funds from legacy capabilities to directly support developing and buying near gear more in line with future operating concepts.

The two most contentious decommissionings are likely to be cruisers and littoral combat ships.

The Navy plans to retire seven cruisers in FY22, five of which are reaching the end of their planned lives and two of which are being retired early.

“Less-capable cruisers with ballistic missile defense only capability are being divested to fund more capable air defense commander (ADC) ships. There were several reasons that led to the decision to divest of these ships. First, divestment allows investment in higher priority capability and capacity. Second, divestment enables the Navy to fund other guided missile cruisers and prioritize the completion of critical modernization availabilities. Third, cruiser modernization costs have grown 90 to 200 percent more than the initial programming estimates,” the budget document read.

Among the cruisers set for retirement in FY22 are Hue City and Anzio, which are among the younger ships in the Ticonderoga class and have gone through the early stages of the three-part cruiser modernization program. With the Navy seeing difficulties with several of the four ships currently in the modernization program, the Navy is choosing to retire Hue City and Anzio instead of finish the work on the ships that sometimes deploy as independent ships and other times deploy with a carrier strike group to act as the lead for air and missile defense.

“From an air and missile defense commander (AMDC) capability perspective, [Hue City] would have likely returned from CG modification ‘late to need.’ Due to current delays in early CG modification ships greater than one year, the ship would likely not return to operational status until after the low-point inventory of AMDC capable ships. DDG Flight IIIs and selective service life extension of [air defense commander] cruisers will provide future needed ADC capability,” according to budget documents.

Decommissioning Hue City and Anzio alone would free up $369.1 million for the Navy to invest elsewhere.

Gumbleton said that, over the five-year Future Years Defense Program, retiring the two cruisers would save $1.5 billion that could be reinvested into higher Navy priorities.

Additionally, the Navy is again asking to decommission two of the original LCSs — plus two more — which Congress previously rejected.

The Navy argues that LCSs 1 through 4 were built with research and development funds as prototypes, and that enough changes were made when the production line began with ships 5 and 6 — odd ones made by Lockheed Martin and even ones made by Austal USA — that the original four are not deployable. It would takes several billion dollars to modify them for combat, which the Navy argues is not a good use of money.

Congress has responded that the Navy could fulfill some missions with these ships, such as counter-trafficking operations in U.S. Southern Command. For FY21, Congress allowed the Navy to decommission the littoral combat ships Freedom and Independence but not Fort Worth and Coronado.

Friday’s budget request asks to decommission Fort Worth and Coronado again, along with two of the first production-line ships from Lockheed Martin, Detroit and Little Rock.

The Lockheed ships have experienced ongoing issues with their combining gear. In January, the Navy announced it would stop accepting delivery of Lockheed ships until the company addressed the material defect. As of January, the Navy said Lockheed should bear the cost of fixing in-service ships, but the two sides hadn’t reached an agreement on how to pay for the fixes.

A senior defense official on May 27 said the LCS Milwaukee, Lockheed’ first production-line ship, is currently testing the anti-submarine warfare mission package and will be the first to deploy with it. As for the rest of the Lockheed ships, the official said: “We looked at the odd-numbered hulls that have had some issues with them — you’ve all probably know and have written about the combining gear issues that we’ve had on some of those odd-numbered LCSs. As we work through those, again, you’re at this trade-off” between “retaining incredible capability” that LCSs can provide the fleet and getting rid of ships that aren’t proving to be worth the money.

Another divestment the Navy plans is one dock landing ship, which would free up $200 million to start buying the new light amphibious warships the Navy and Marine Corps need for future littoral operations in a contested environment as well as expeditionary advanced base operations.

Readiness spending

The service is boosting spending on ship maintenance as well as shipyard facilities.

The Navy is asking for $13.8 billion for ship maintenance, including $1.3 billion for a pilot program that allows the Navy to use money that remains available for as long as three years for ship repairs at private yards instead of the traditional operations and maintenance money that has to be spent in the year it’s appropriated or else it disappears. The pilot program began with U.S. Pacific Fleet and was positively received as helping keep ship maintenance availabilities on track even if they slip from the end of one fiscal year into the beginning of the next. This year’s budget request calls for the pilot program to extend to East Coast shipyards, too.

Though the Shipyard Infrastructure Optimization Plan — a 20-year, $21 billion plan to overhaul the four public shipyards — is still largely in the planning phase, the budget request calls for $250 million to improve a dry dock at Portsmouth Naval Shipyard in Maine and $156.4 million for a dry dock saltwater system for the Ford-class aircraft carrier at Norfolk Naval Shipyard.

Megan Eckstein is the naval warfare reporter at Defense News. She has covered military news since 2009, with a focus on U.S. Navy and Marine Corps operations, acquisition programs and budgets. She has reported from four geographic fleets and is happiest when she’s filing stories from a ship. Megan is a University of Maryland alumna.