The increased speed at which VA loans are being refinanced, known as “churning,” has prompted action from senators and from Ginnie Mae, a government-owned corporation that backs mortgage securities.

And while the bipartisan Senate bill is in its early stages, the move by Ginnie Mae warning nine lenders to stop their aggressive loan practices ― get some of the names and the reaction here ― already may be paying off.

Ginnie Mae-backed bonds “have been responding positively to the announcement” of the warnings, said Michael Bright, the agency’s executive vice president and chief operating officer, on Thursday. “They’re putting downward pressure on VA rates. … Higher bond prices equal lower interest rates on your mortgage.”

RELATED

That’s the big-picture reason why putting an end to churning would be good news for VA loan users. The small-picture reason could be sitting in your mailbox now: Solicitations from multiple loan companies inviting you to refinance your VA-backed mortgage.

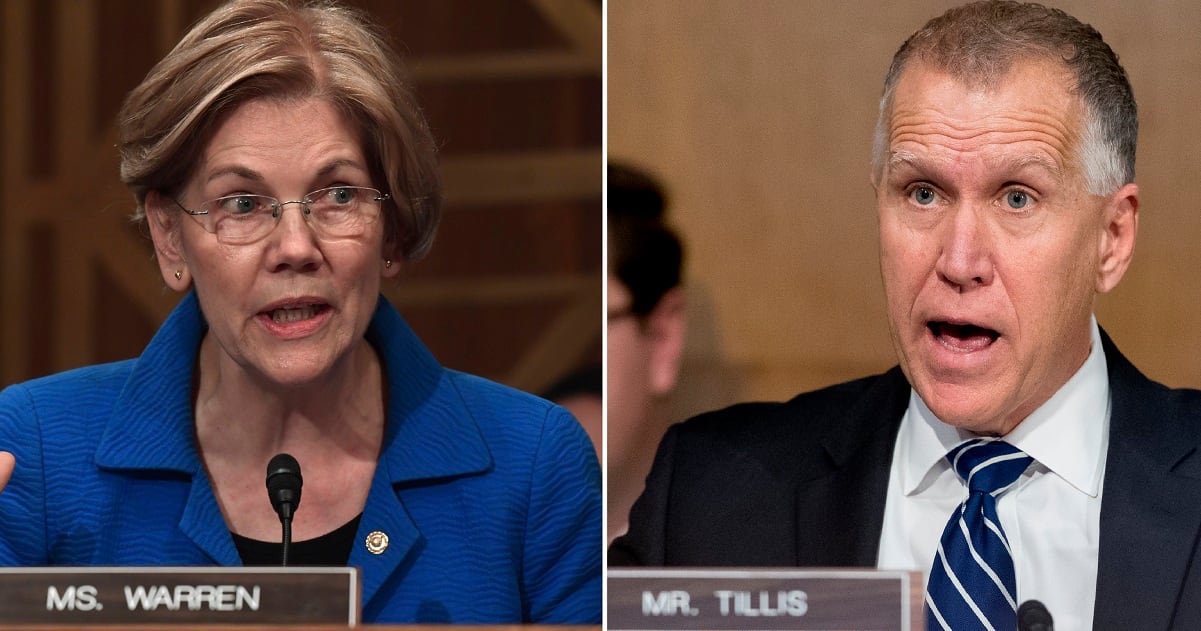

The bill put forward by Sens. Thom Tillis, R-N.C., and Elizabeth Warren, D-Mass., addresses some of these concerns, with rules that would force lenders to provide a “net tangible benefits test” that outlines savings on a refinance over time. It would also require all fees associated with refinanced VA loans be recouped within 36 months.

It could also declutter that mailbox while you unpack, making it illegal for lenders to offer VA-backed refinancing within six months of the original VA loan being signed.

Senior Staff Writer Karen Jowers contributed to this report.

Kevin Lilley is the features editor of Military Times.