The U.S. Education Department has told its student loan servicers to review their records in order to provide refunds to military borrowers who were overcharged in violation of the Servicemembers' Civil Relief Act.

Department of Education officials have directed its student loan servicers to conduct reviews in order to provide refunds to military borrowers who were overcharged on their interest payments on their federal student loans, in violation of the Servicemembers Civil Relief Act.

Student loan servicers — companies that manage loans for the government or other companies — will have to examine their records back to 2008, when the law was changed to apply a 6 percent interest rate cap to federal student loans meeting the SCRA requirements, according to a letter the Education Department sent to some senatorsmembers of the Senate Health, Education, Labor and Pensions Committee.

Education Department officials notified the Senate Health, Education, Labor and Pensions committee that they have directed their loan servicers to conduct a review of their records dating back to 2008, when the law was changed to apply the 6 percent interest rate cap to federal student loans meeting the requirements of the SCRA.

Under the SCRA, to receive the 6 percent interest rate cap, a loan must have been made before the service member was called to active duty, and the active-duty member must provide the lender with a written notice of eligibility of the interest rate cap, as well as a copy of the service member's orders.

This applies to Guard and reserve members while they are called to active duty, as well as to active-duty troops who received the loan before entering the military.

Education officials, in a letter to members of the Senate Health, Education, Labor and Pensions Committee, said they've started the process to automatically provide credit for any service member who was on active duty since federal student loans became eligible for the reduced interest rate under SCRA. It would apply to any eligible service member, regardless of whether they applied for the benefit, the officials said.

Information was not immediately available about when the reviews will be completed.

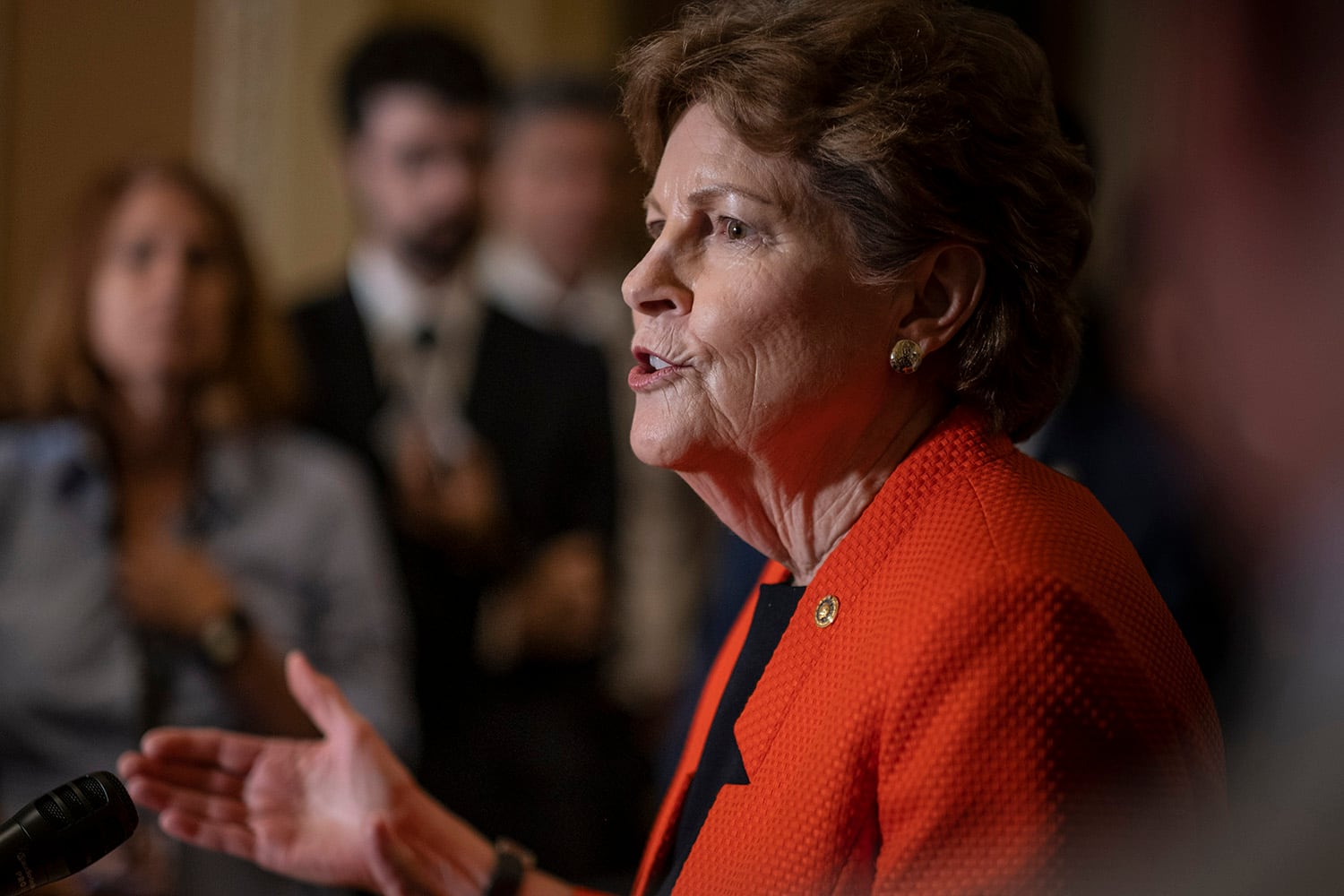

"This is a step in the right direction, but I will continue to hold the [Department of Education] accountable for protecting military borrowers and work on ways to ensure these violations never happen again," said Sen. Patty Murray, D-Wash., in a March 7 statementannouncing the committee had been notified of the Department of Education's actions.

"I am pleased the department will correct this injustice and refund all military borrowers for the money they were overcharged on their student loans," said Murray, in the statement. "Since this mistreatment first came to light, I have pressed for answers and action, because one service member cheated on their student loans is one too many."

Murray and Sens. Elizabeth Warren, D-Mass.; Richard Blumenthal, D-Conn.; and Richard Durbin, D-Ill., sent a letter March 3 to the Education Department seeking help for service members who have been overcharged on student loans. That was in response to the Feb. 29 release of a review by the Education Department Inspector General that found errors with the department's previous examination of loan servicers' compliance with the SCRA.

An Education Department press release last May 26 stated that "in less than 1 percent of cases, borrowers were incorrectly denied the 6 percent interest rate cap required by the laws." But according to the inspector general, the press release was wrong.

The senators noted in their March 3 letter they had sought assurances for two years that the Education Department would conduct thorough reviews of all federal loan servicers to determine how many military borrowers had not received the SCRA benefit.

In 2014, the Justice Department filed a complaint against Navient, a loan servicer that was formerly part of Sallie Mae, alleging that it failed to cap the interest rate of eligible service members.violated the SCRA by failing to provide service members the 6 percent interest rate cap they were due.

Last May, the Justice Department announced a settlement with Navient that would pay $60 million to 77,795 borrowers to resolve allegations of SCRA violations. About 74 percent of the loans were private, 21 percent were guaranteed by the Education Department, and 5 percent were loans owned by the Education Department. Check amounts were, on the average, $771, but the amount depended on a variety of factors, such as how long the interest rate exceeded 6 percent and by how much, according to the Justice Department.

In their response to the HELP committee, Education officials stated, "We are currently reviewing and take very seriously the issues raised by the Inspector General and will take any appropriate steps to ensure that the department's reviews of financial institutions meet the highest standards."

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.