Inflation is “destroying any joy we may have been able to afford,” the airman wrote. “We are literally grasping at pennies to survive and it’s killing us.”

Statements from the airman — stationed at Holloman Air Force Base, New Mexico — and many others came in response to Military Times’ call for comments on how inflation has impacted service members and their families.

Most responded with a common theme: Families are “cutting back” or “eliminating” everything from grocery shopping and driving to subscription services, vacations and eating out.

Consumer prices were up by 3% from June 2023 to June 2024, according to the Bureau of Labor Statistics. That’s on top of inflation over the previous several years.

“Literally turning a trip to McDonald’s into a big event. How sad is that?” wrote Airman 1st Class Onorio Franco Jr., stationed at Holloman AFB.

“A trip to McDonald’s for my wife, 1-year-old daughter and myself is upwards of $40. That’s just one meal,” he added. “For two 6-inch subs and two drinks from the commissary, it costs $20. ... Obviously on an E-3 pay we cannot afford to go out and enjoy that.”

An Air Force tech sergeant stationed at F.E. Warren Air Force Base, Wyoming, said he and his wife are spending twice as much on groceries at their local grocery store as they were in 2021.

Once a week they’re spending an average of $200 to $210 — compared to $100 to $130 in 2021 — for their family of four children.

Melissa Godoy’s husband is an Army sergeant first class stationed at Joint Base Lewis-McChord, Washington.

“Even at his [E-7] pay, we are still barely able to stay afloat,” said Godoy, who also is a freelance grant writer with sporadic income. “We spend $800 to $900 a month on groceries now. Two adults, two kids. That’s almost twice as much as it was in 2019.

“Utilities are overwhelming. We are behind on electricity. Gas is $3.50 to $4.40 a gallon. You have to find the cheap gas stations. My husband drives 40 minutes to and from work every day. He spends $400 a month just for gas.”

They, too, are doing “a lot of eliminating, and that’s not fair for us. ... We can’t afford to live and save money. Something always breaks, a bill pops up and is due, something is always needed,” she said.

Housing costs remain an issue. A Navy E-6 wrote that the most recent increase in the Basic Allowance for Housing was “incredibly necessary.”

Her experience sharply illustrates the rising costs. She and her husband are preparing to move back to a previous duty station, where, just three years ago, the same two-bedroom apartment for which she once paid $1,400 a month now costs $2,100 a month, she wrote.

Military families are adjusting in a variety of ways. The Godoy family rarely eats out, Melissa Godoy said.

“We budget, and stay home as much as possible. Living a slow, boring life has allowed us to be able to make it from paycheck to paycheck.”

An Army sergeant first class stationed at Fort Campbell, Kentucky, said his family of seven has been “exponentially” affected by inflation and has cut back on the amount and type of groceries they buy, with more raw products and less pre-made items.

“We have given up on indulgences by getting no name brands, cheaper cuts of meats, eating meat less,” he wrote.

They’ve also cut other items from their budget, such as streaming or subscription services, in order to afford groceries.

The E-7′s family now does more comparison shopping and drives to different stores, but buys in bulk to save money on gas by making fewer trips.

Vacations, meanwhile, have been drastically cut back if not eliminated altogether.

“We now only do vacations closer to home and only once a year,” wrote the Fort Campbell soldier.

“It’s absolutely ridiculous to think of planning a trip, going to an event, or even buying anything special when our strict budget still holds us down to under $200 at the end of months,” the airman first class said. “How are we supposed to save, buy toys for our daughter [or] go visit family to share these moments with her grandma and grandpa?”

Some military families have made other lifestyle changes.

“Our family has gone to great lengths to conserve financial resources and stretch every dollar,” said America Lunsford, who lives with her two children and husband, an Army staff sergeant.

Last year, they took advantage of the VA loan for their new home. Their homeschool curriculum includes a home garden for fresh vegetables that’s also the foundation of their ninth-grader’s farm-to-table bistro startup.

They’ve researched the best methods for food preservation to minimize waste, and have started a compost to provide nutrients to the garden. They use washable napkins, grow their own loofah sponges, and upcycle things like glass jars and mesh produce bags. Many other needs are met through community networking and local nonprofits.

“Sustainable giving/trading, repurposing items or shopping second hand is another way we practice sustainability and limit wasteful spending,” she said.

Their single-income, single-car household has also transitioned their medical care to providers that offer telehealth options in order to minimize gas and time.

They take advantage of rewards programs and memberships, but shop local when possible.

“We also review insurance policies yearly to adjust for price hikes and compare costs,” she said.

Help is out there

Inside and outside the military community, there are resources to help military families stretch their dollars.

Melissa Godoy administers a Facebook group in her local Joint Base Lewis-McChord area, called JBLM family resources, “where I direct families to food banks, diaper banks and free resources to be able to make it from day to day,” she said.

“Military families are in dire straits right now,” she added.

Military relief societies are longstanding resources available to help military families with emergency financial assistance.

Depending on the situation, Army Emergency Relief, Air Force Aid Society, Navy-Marine Corps Relief Society and Coast Guard Mutual Assistance provide grants service members don’t have to pay back, as well as zero-interest loans.

“The need is clearly there as requests hold steady with the economy affecting a large amount of active duty and retired populations,” said Sean Ryan, a retired Army colonel and spokesman for Army Emergency Relief.

This year, Army Emergency Relief has helped more than 13,800 active duty soldiers and families with nearly $27 million in financial assistance. Another 11,800 retired soldiers have received more than $26 million in aid.

“If a soldier is at a point where they need to visit a food bank, we urge them to come to AER for assistance immediately, and they don’t have to go through their chain of command,” Ryan added. “Supporting soldiers is the reason we exist and these are difficult times.”

Food insecurity normally ranks number 9 or 10 overall in assistance categories, but in the last two years it’s moved up to number 6, Ryan said.

“So, [it’s] definitely something we are paying attention to and looking for ways to provide more support.”

Many other organizations in and around the military community step up to help military families with financial assistance. The Military Family Advisory Network holds periodic food distribution and other events for military families; a number of food pantries near military bases work with local military families.

For example, the nonprofit Stronghold Food Pantry in Leavenworth, Kansas, provides needed items for military families via donations from groups and businesses, such as Armed Forces Bank.

“We see firsthand, they can’t keep up with the demand, whether it’s diapers or peanut butter,” said Tom McLean, senior vice president and military executive at Armed Forces Bank.

The bank currently has branches on 11 military installations around the country, one outside the gates at Fort Riley and one more in the vicinity of Fort Leavenworth.

Many organizations focus on assistance for junior enlisted families, such as Armed Services YMCA and Operation Homefront, which runs family-focused events like back-to-school drives, holiday meal distribution and baby showers. The organization is expecting to distribute 20,000 backpacks this summer.

But one particular measure Operation Homefront provides is a gauge of how inflation is affecting military families.

The organization’s Critical Financial Assistance program helps families with immediate needs, such as rent, utility and car payments, with its main focus toward recently separated personnel and wounded or ill service members.

“The number of Critical Financial Assistance requests have followed inflation’s trend, with housing, food, and utilities assistance being the most frequent types of needs we’re seeing,” said April Postell, the nonprofit’s senior director of the Critical Financial Assistance department.

Since the program’s 2012 launch, more than 57,000 requests have been filled, totaling $42.5 million in critical financial assistance, said retired Air Force Brig. Gen. Bob Thomas, the nonprofit’s president.

“We had a pretty predictable demand until COVID, then the demand spiked. It moderated, but is still above what it once was,” he said.

Typical requests for assistance are about $880, he added. Each application has about three requests, with inflation cited in military families’ inability to save.

“A very high percentage of military families are living paycheck to paycheck,” he said. “A lot ... move every two to three years, and those moves are very expensive.”

“There are a lot of unique challenges the military go through,” Thomas added. “In the end, it means they’re very fragile financially” when they leave the service.

The first time something unexpected happens, such as an expensive car repair, it puts families in a vulnerable spot.

“Our mission is to build strong, stable and secure military families so they can thrive,” Thomas said.

“These families have been there for all of us in our nation’s time of need. We want to be there for them in their time of need.”

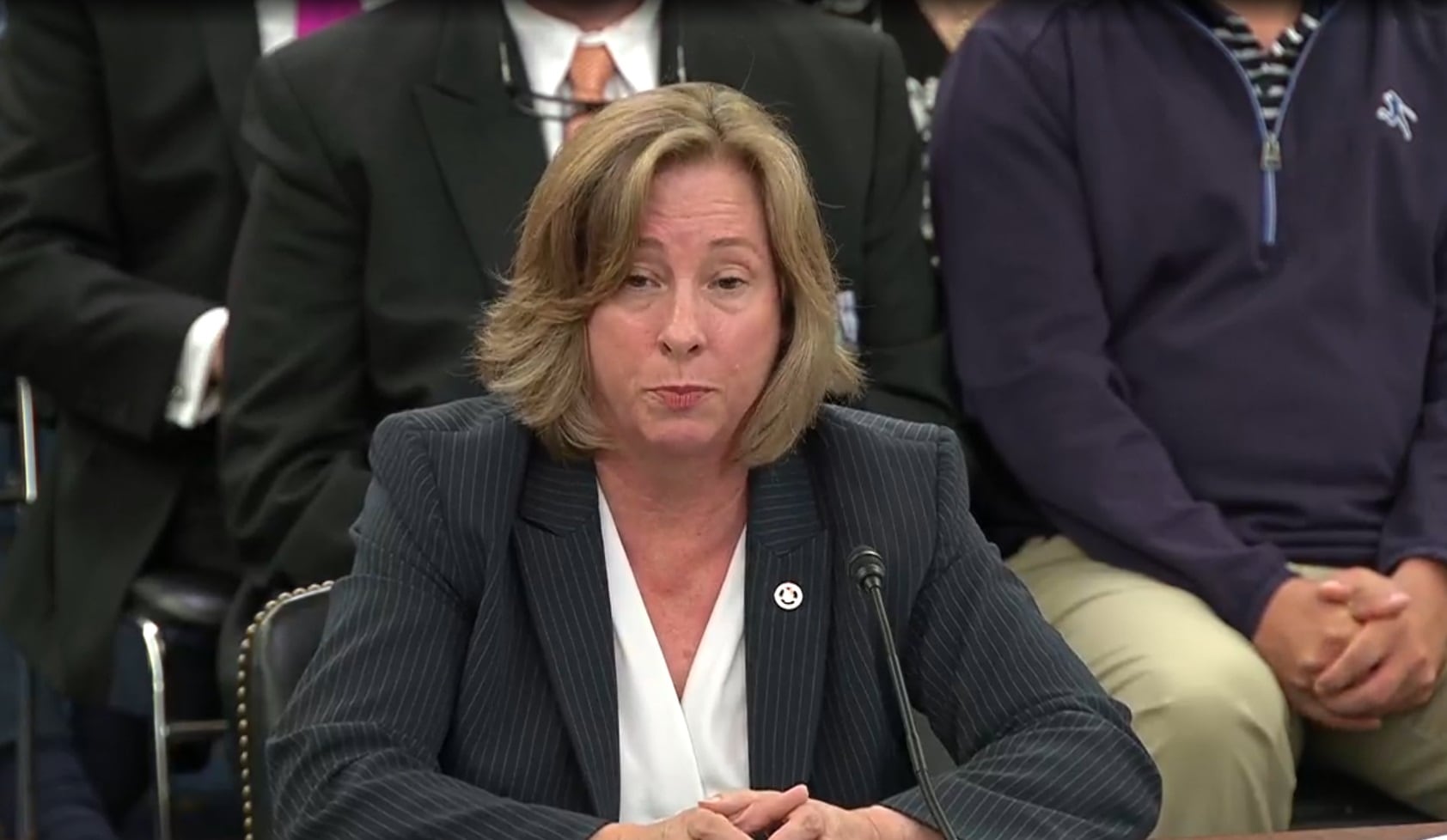

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.