As 2018 comes to a close, many of us are doing the thing we always do: making New Year’s resolutions.

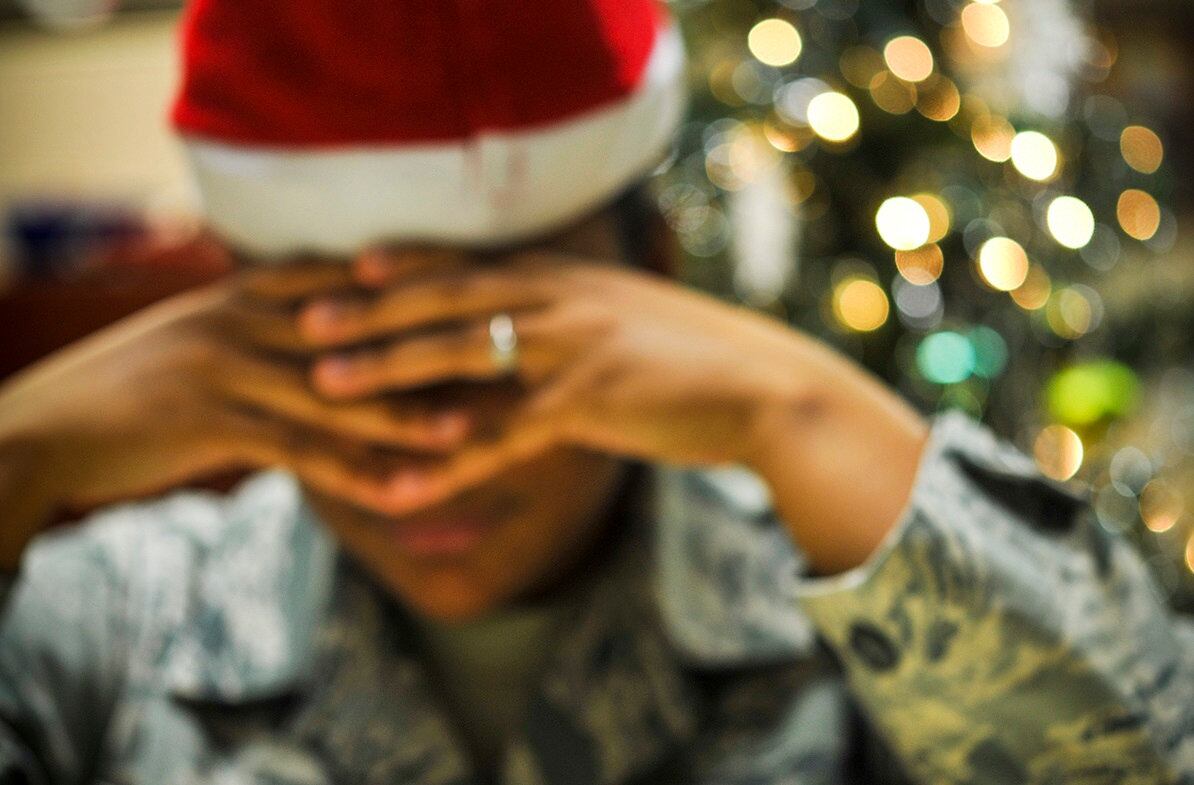

If your resolutions have something to do with money, start small. Too many people fail to carry through with their resolutions, and when it comes to finances, seemingly small steps can add up and motivate you to do more. Keeping on top of finances is especially important for military personnel, as it could affect their security clearance.

Here are a few ideas to consider for your resolutions.

1. Assess your finances. Set aside an hour or two to tally up your consumer debt — like credit cards, personal loans, car loans — and your savings and investments, if any. Then compare your monthly income to your monthly expenses. How much is left over after your expenses to pay down debt and to put toward savings? Some areas might emerge that need some work.

2. Get a free copy of your credit report and check it for accuracy. By law, you’re allowed to get one free report from each of the three nationwide credit reporting companies every 12 months. You can get them all at once or space them throughout the year. Only one site is authorized to give you the free credit report: annualcreditreport.com.

3. Get a free credit score and analysis from FINRA Investor Education Foundation. You can get the report by contacting your personal financial management program office. If you don’t have a local contact, visit www.saveandinvest.org/free-credit-score-and-analysis-tool for more information. Your credit score comes from the information in those credit reports about your debt and payment history; Lenders, landlords and others use your credit score to determine your creditworthiness.

4. Tackle one debt at a time. Put in every possible penny into one and make minimum payments on others before moving to the next debt. Some tackle the debt with the highest interest rate first. Others tackle the card with the lowest balance first. Find some ways to get a jump start on the debt, such as returning items you bought but didn’t need during the holiday season and apply those refunds toward the debt.

5. Get help from experts if your debt seems insurmountable. Free help is available in the military community. Personal finance managers on military installations and personal financial counseling available through MilitaryOneSource.mil can help you embark on a plan to knock out that debt.

RELATED

6. Ask yourself before you make a purchase: Is this a want, or a need? Putting that $5 or $100 toward paying off debt or putting it into a savings account might make you feel better in the long run.

7. Ask yourself a question before taking on a big debt. Will we be able to make the payments if my spouse isn’t can’t find a job when we move to the next duty station?

8. Start or boost your emergency fund. An initial goal is $500. Save $10 (a couple of lattes or lunches) a week for a year, and you’re there. You can build it up later to equal three- to six months’ worth of living expenses. Having that cushion could help you avoid using a credit card for emergency car repair.

9. Contribute at least 5 percent of your basic pay to your Thrift Savings Plan. You should do this regardless of whether you’re in the new Blended Retirement System. But it’s especially important if you’re in the BRS. If you don’t contribute at least 5 percent under the BRS to get the 5 percent matching contribution, you’re in effect turning down money from DoD.

10. Celebrate your successes. No matter how small.

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.